are combined federal campaign donations tax deductible

This annual campaign for federal government civilian employees US Postal Service workers and members of the military has generated more than 280773 for ARRL programs since it first became an option for. Follow this link to find out more about how to contribute to Food For The Poor through the CFC and please contact us at 877-654-2960 ext.

Combined Federal Campaign Islamic Relief Usa

This year the CFC celebrates its 60th anniversary.

. For nearly 20 years the US Office of Personnel Management has designated the ARRL participant 10099 to participate in the Combined Federal Campaign. Donors who are eligible to itemize charitable contributions on income tax returns may include contributions made through the CFC. Congratulations to our Headquarters community on the conclusion of a very successful 2014 Combined Federal Campaign CFC.

According to OPM you can deduct even if you take the standard deduction and do. If an individual donates property other than cash to a qualified organization the individual may generally deduct the fair market value of the. Yes you can deduct them as a Charitable Donation if you file Schedule A.

Your generous tax deductible donations allow us to carry out our mission. The Combined Federal Campaign CFC makes automatic deductions from your salary each pay period and sends your gift to your chosen organization or cause within the CFC. For nearly 20 years the US Office of Personnel Management has designated the ARRL participant 10099 to participate in the Combined Federal Campaign.

YOUR CFC DONATION TO ACUF IS ALSO. Your tax deductible donations support thousands of worthy causes. We exceeded our Headquarters financial target of 264100 by 12 percent collecting a total of 297361 in pledges and donations and more importantly raised our participation.

If a donor makes a CFC payroll deduction are those contributions taken pre-tax or after-tax. Even small donations have an huge impact. 2014 Combined Federal Campaign Results.

The CFC is comprised of 30 zones throughout the United States and overseas. Donors should contact a tax advisor for more information. The Combined Federal Campaign CFC The Combined Federal Campaign promotes and supports philanthropy through a program that provides all federal employees postal employees and members of the military the opportunity to improve the quality of life for all.

Federal law does not allow for charitable donations through payroll deduction CFC or any other. And since all participating recipients are 501 c 3 organizations you will enjoy a combined federal campaign tax deduction. 60 Years of Giving.

Federal law does not allow for charitable donations through payroll deduction CFC or any other payroll deduction program to be done pre-tax. While tax deductible CFC deductions are not pre-tax. How to get to the area to enter your donations.

Thank you for contributing through the Combined Federal Campaign CFC. Every year NASA Headquarters employees step up and make a positive impact on the lives of those around us. Welcome to the Combined Federal Campaign.

Money given to the Brady Campaign is not tax-deductible and will go to fund political activities such as asking Congress to finish the job of expanding background checks to all gun sales. Overseen by the Office of Personnel Management OPM the Combined Federal Campaign is the official workplace giving campaign for federal employees and retirees. Join the 2021 Combined Federal Campaign CFC and donate to MACV today.

If interested in making a stock donation please call MACV headquarters at 651-291-8756 for more information. Each of these zones has. From travel to trade American diplomacy has built bridges from the United States to others around the world.

We look forward to your participation in this years campaign every person and every donation this year will make a difference and is truly appreciated. Through the generous contributions of supporters like you we continue to leverage the leadership of our nations heroes to better communities nationwide. Contributions must actually be paid in cash or other property before the close of an individuals tax year to be deductible for that tax year whether the individual uses the cash or accrual method.

Tax-deductible Provides ACUF with unrestricted funds Easy. Federal retirees and contractors working in a federal facility can also make a one-time deduction. Can I deduct my contributions to the Combined Federal Campaign CFC.

The Combined Federal Campaign CFC makes automatic deductions from your salary each pay period and sends your gift to your chosen organization or cause within the CFC donation list. Medical and dental care are basic. And since all participating recipients are 501c3 organizations you will enjoy a combined federal campaign tax deduction.

The 2012 National Capital Area Combined Federal Campaign CFC is underway. The Combined Federal Campaign is happening now until January 15 2022 allowing personnel and retirees to pledge monetary support and volunteer time to approved charities. All Combined Federal Campaign CFC donations are tax-deductible.

Food For The Poor is an approved charity through the Combined Federal Campaign. Combined Federal Campaign CFC Are you a federal employee or retiree. Our number for the campaign is CFC 10328.

Your donation during the 2021 Combined Federal Campaign CFC 30585. All contributions made through the CFC are tax-deductible. Click here to access our most recently available annual financial statements and 990 tax filings.

This annual campaign for federal government civilian employees US Postal Service workers and members of the military has generated more than 280773 for ARRL programs since it first became an option for giving by. Your donation during the 2021 Combined Federal Campaign CFC 30585 will help the National Museum of American Diplomacy NMAD tell the story of those who foster a global community and open the door to a safer more prosperous and culturally rich world. While inside the software and working on your return type charitable donation in the Search at the top of the screen you may see a magnifying glass there.

Money given to the Brady Center is tax-deductible and will go to combating crime guns helping our legal team fight for justice and promoting our public health and safety campaigns. Ad A Bit of Planning Now Can Keep You From Tax Filing Troubles Next Year. AFSPs Combined Federal Campaign CFC number is 10545.

13 Tips For Making Your Charitable Donation Tax Deductible In 2017 Access the Nonprofit Portal to submit data and download your rating toolkit. Is a 501c3 organization with an IRS ruling year of 2009 and donations are tax-deductible. Thank you for contributing through the Combined Federal Campaign CFC.

A Quick Guide To Deducting Your Donations Charity Navigator

What Is The Combined Federal Campaign Article The United States Army

Are Political Contributions Tax Deductible H R Block

Ways To Give Believe In Tomorrow Children S Foundation

A Quick Guide To Deducting Your Donations Charity Navigator

Are Political Donations Tax Deductible

How Much Should You Donate To Charity District Capital

Federal And California Political Donation Limitations Seiler Llp

Are Political Contributions Tax Deductible H R Block

Combined Federal Campaign National Association Of Letter Carriers Afl Cio

Federal Retiree Giving Combined Federal Campaign Of Southern California

How The 3 Campaign Contribution Check Box On Your Tax Form Works Marketplace

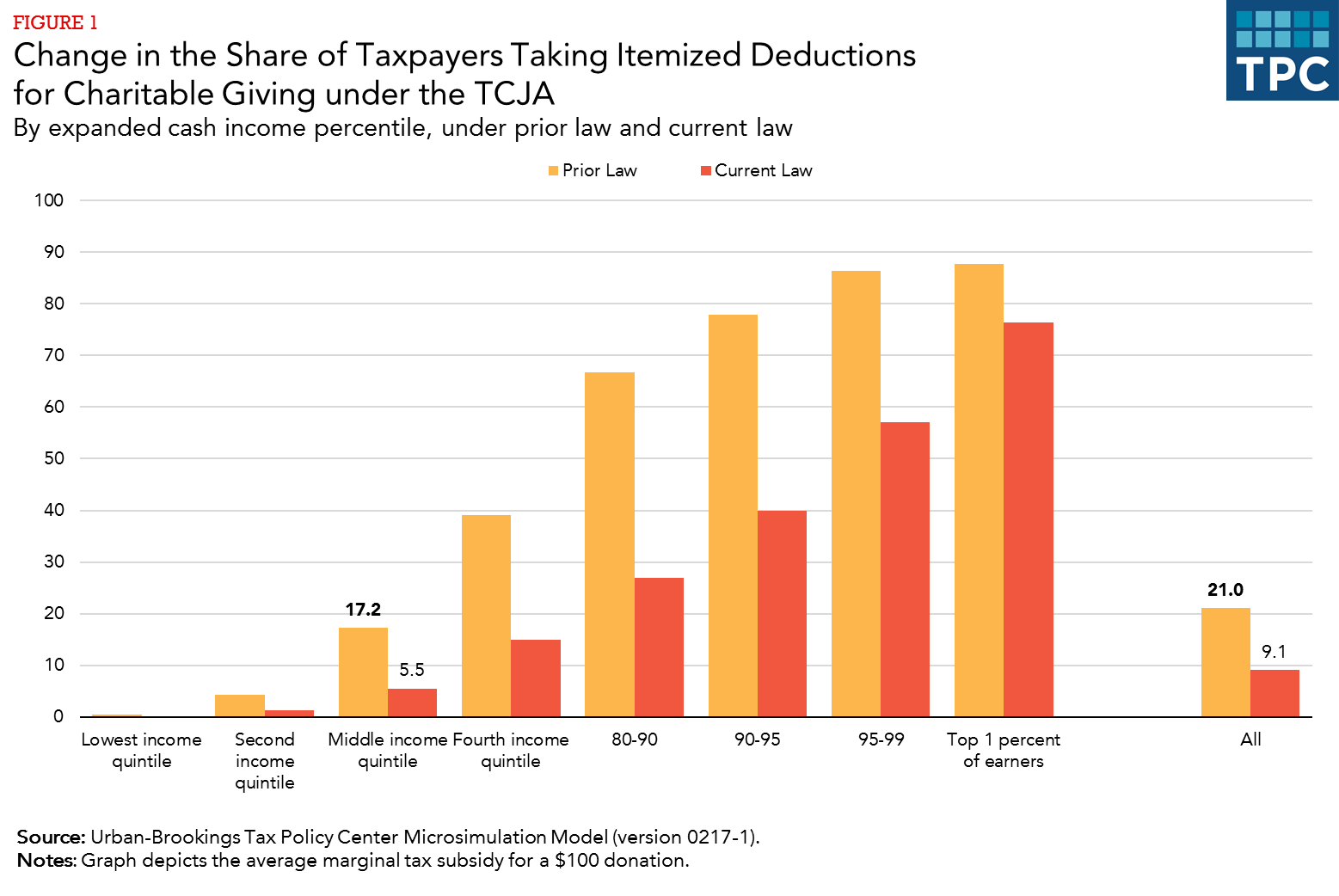

How Did The Tcja Affect Incentives For Charitable Giving Tax Policy Center

Tax Deductible Donations Can You Write Off Charitable Donations

A Quick Guide To Deducting Your Donations Charity Navigator

Charitable Deductions On Your Tax Return Cash And Gifts

Four Ways To Maximize Charitable Giving Impact In 2021 Schwab Charitable Donor Advised Fund Schwab Charitable