iowa homestead tax credit application

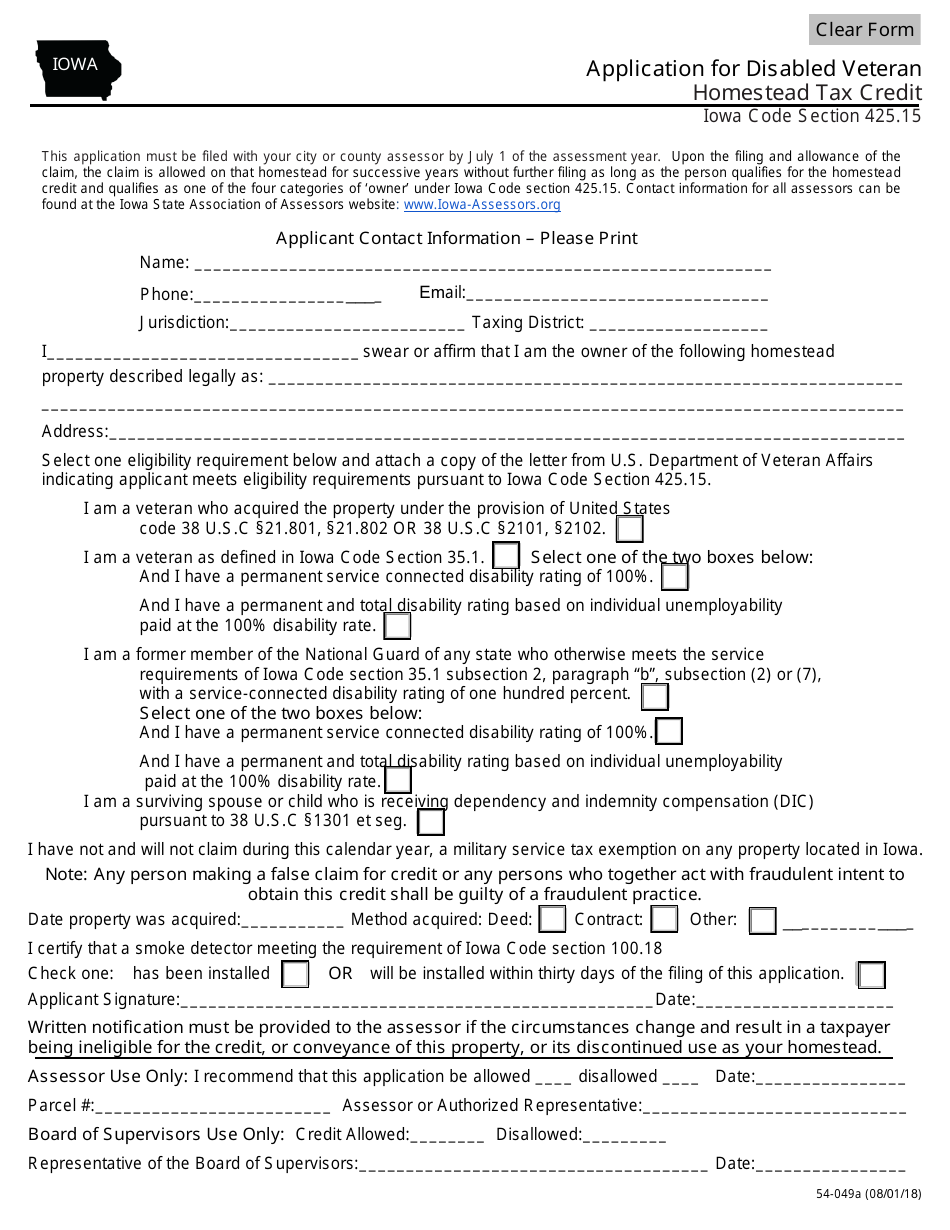

Upon filing and allowance of the claim the claim is allowed on that homestead for successive years without further filing as long as the person qualifies for the homestead credit. This credit may be claimed by any 100 disabled veteran of any military forces of the United States.

Homestead Tax Credit More Mop Boley Real Estate

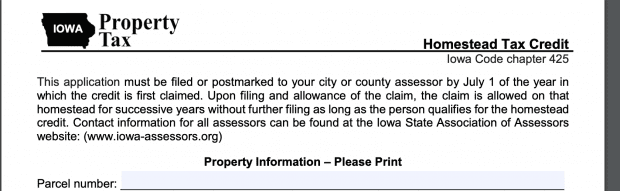

Application for Homestead Tax Credit Iowa Code Section 425.

. Homestead Credit Application click here To qualify for the credit the property owner must be a resident of Iowa occupy the property on July 1 and for at least 6 months of every year. Tax credit to a disabled veteran with a service related disability of 100. It is a onetime only sign up and is valid for as long as you own and occupy the home.

Homestead Tax Credit Application 54-028 Iowa Department Of Revenue. Click on the appropriate credit in this case the Homestead Tax Credit. Upon the filing and allowance of the claim the claim is allowed on that homestead for successive years without further filing as long as the person qualifies for the homestead.

When you are in the parcel that your home is on next to Submission click on Homestead Tax. Application for Homestead Tax Credit Iowa Code Section 425. It must be postmarked by July 1.

52240 The Homestead Credit is available to all homeowners who own and occupy the. Iowa Disabled Veteran Homestead Credit. 54-028 012618 IOWA.

This application must be filed or mailed toyou r city or county assessor by July 1 of the year in which the credit is first claimed. Search for your address and scroll down to Tax Credit Applications. For additional information and for a copy of the application please go to the Iowa Department of Revenue web site.

If it is being rented you are not eligible to file a. Upon filing and allowance of the claim the claim is allowed on that homestead for successive years without further filing as long as the person qualifies for the homestead credit. Homestead Tax Credit Iowa Code Section 42515 54-049a 080118 IOWA This application must be filed with your city or county assessor by July 1 of the assessment year.

Iowa Code chapter 425 This application must be filed or postmarked to your city or county assessor by July 1 of the year in which the credit is first claimed. The 9 housing tax credit program is a highly-competitive process and applications may be submitted annually. Homestead Tax Credit 54-028.

This application must be submitted to your city or county assessor by July 1 of the year in which the credit is first claimed. The Tax Management Division of the Iowa Department of Revenue is responsible for all facets of tax processing from the receipt of returns and payments through examination. 913 S Dubuque St.

This application must be filed or mailed toyou r city or county assessor by July 1 of the year in which the credit is first claimed. Homestead Property Tax Credit Application. Iowa Military Exemption.

Fill out a blank form see following pages. For properties located within city limits the maximum size is 12 acre where the home and the buildings if any are located. New applications for homestead tax credit are to be filed with the Assessor on or before July 1 of the year the credit is first claimed.

January 8 2021 703 PM. Homestead Tax Credit Iowa Code chapter 425. Provides information on tax credits and exemptions for Iowa State including filing questions and the application process for the homestead property tax credit and the military service tax exemption.

Of Veterans Affairs press release PDF Application Form. Upon filing and allowance of the claim the claim is allowed on that homestead for successive years without further filing as long as the person qualifies for the homestead credit. Upon filing and allowance of the claim the claim is allowed on that.

Danilson Law advises buyers to apply for the homestead tax credit within 30 days of closing on your purchase as life gets busy and this is one benefit that you either claim or your dont receive if the deadline passes. The amount of exemption varies. Applying for the Iowa Homestead Tax Credit.

To qualify you must have a DD-214 Discharge and Separation Form recorded with the Des Moines County Recorders Office. It must be postmarked by July 1. Contact Story County Treasurer for Application 515-382-7330.

Potential applicants are encouraged to familiarize themselves with all requirements including previous experience and training. You can apply for the Iowa Homestead Tax Credit by filling out Homestead Tax Credit Application 54-028. Upon filing and allowance of the claim the claim is allowed on that.

Either way you must apply for the homestead tax credit as its benefit is not automatic for homeowners in Iowa. Must own the property on July 1 of each claim year. Click on the appropriate credit in this case the Homestead Tax Credit.

Under Real Estate Search enter your property address. IOWA Homestead Tax Credit Iowa Code chapter 425 and Iowa Administrative Code rule 701 801 This application must be filed or postmarked to your city or county assessor on or before July 1 of the year in which the credit is first claimed. This exemption is a reduction of the taxable value of their property amounting to a maximum 4850 or the amount which does not.

Full requirements are available in the Qualified Allocation Plan for that year. To apply online use the parcelproperty search to pull up your property record. To be eligible a homeowner must occupy the homestead any 6 months out of the year but must reside there on July 1.

Follow the prompts to electronically send your application to our office. Iowa Code Section 425. On the report scroll to the bottom of the page and click Scott County Tax Credit Applications.

Instructions for Homestead Application You must print sign and mail this application to. Application for Homestead Tax Credit IDR 54-028 073015 This application must be filed with your city or county assessor by July 1 of the year for which the credit is first claimed. Iowa Code section 5612 defines the amount of property that qualifies for homestead treatment and these same definitions apply to the Disabled Veteran Tax Credit.

Iowa City Assessor. It must be postmarked by July 1. Application for Disabled Veterans Homestead Tax Credit Current decision letter and notification showing 100 disabled required.

You can apply for the Iowa Homestead Tax Credit by filling out Homestead Tax Credit Application 54-028. Reduces the taxable value of property for military veterans. Any property owner in the State of Iowa who lives in the property can receive a homestead tax credit.

IOWA To the Assessors Office of CountyCity Application for Homestead Tax Credit Iowa Code Section 425 This application must be filed or mailed to your city or county assessor by July 1 of the year in which the credit is first claimed. Iowa Code Chapter 425. Upon the filing and allowance of the claim the claim is allowed on that homestead for successive years.

Google Image Result For Http Wwp Greenwichmeantime Com Images Usa Wisconsin J Wisconsin Travel Wisconsin Exploring Wisconsin

Apply For Homestead Tax Credit Now

Homestead Credit Reminder Hokel Real Estate Team

Money Creation In A Fractional Reserve Banking System The Simplified Cartoon Version Money Creation Monetary Policy Economics Project

Agriculture Clouds Corn Country Dirt Road Farm Fields Hdr Iowa Landscape Nature Outdoors Rural Sky Sunset Homesteading City Landscape Iowa

Update Regarding Homestead Tax Credit Applications Laughlin Law Firm Plc Jason Laughlin Managing Attorney

/cloudfront-us-east-1.images.arcpublishing.com/gray/KTWHUCEPO5M35BN7EVF4E4XJLE.jpg)

Iowa First Time Homebuyers Get Tax Break

Homestead Tax Credit More Mop Boley Real Estate

Calculating Property Taxes Iowa Tax And Tags

Iowa Homestead Tax Credit Morse Real Estate Iowa And Nebraska Real Estate

Property Tax Exemption Who Is Exempt From Paying Property Taxes

Form 54 049a Download Fillable Pdf Or Fill Online Application For Disabled Veteran Homestead Tax Credit 2018 Templateroller

![]()

Online Credit And Exemption Sign Up Mahaska County Iowa Mahaskacountyia Gov

Iowa Homestead Tax Credit Morse Real Estate Iowa And Nebraska Real Estate

Apply For Homestead Tax Credit Now

What Is A Homestead Exemption And How Does It Work Lendingtree

Claiming Your Homestead Credit Bankers Trust Education

Iowa Is Top Of The List For Retirement States Video In 2021 Iowa House Styles Picturesque

Google Image Result For Http Wwp Greenwichmeantime Com Images Usa Wisconsin J Wisconsin Travel Wisconsin Exploring Wisconsin